Every day, thousands of Dubai investors pay a premium to live closer to the clouds. But what if they're actually paying more to own less?

In 2026, a quiet revolution is reshaping Dubai's luxury market. While mega-towers continue piercing the skyline, the smartest money is flowing downward—into boutique, low-rise communities where buyers own more land, pay less in fees, and enjoy higher quality of life.

Welcome to the G+4 Advantage.

The Numbers Don't Lie: G+4 vs High-Rise Performance

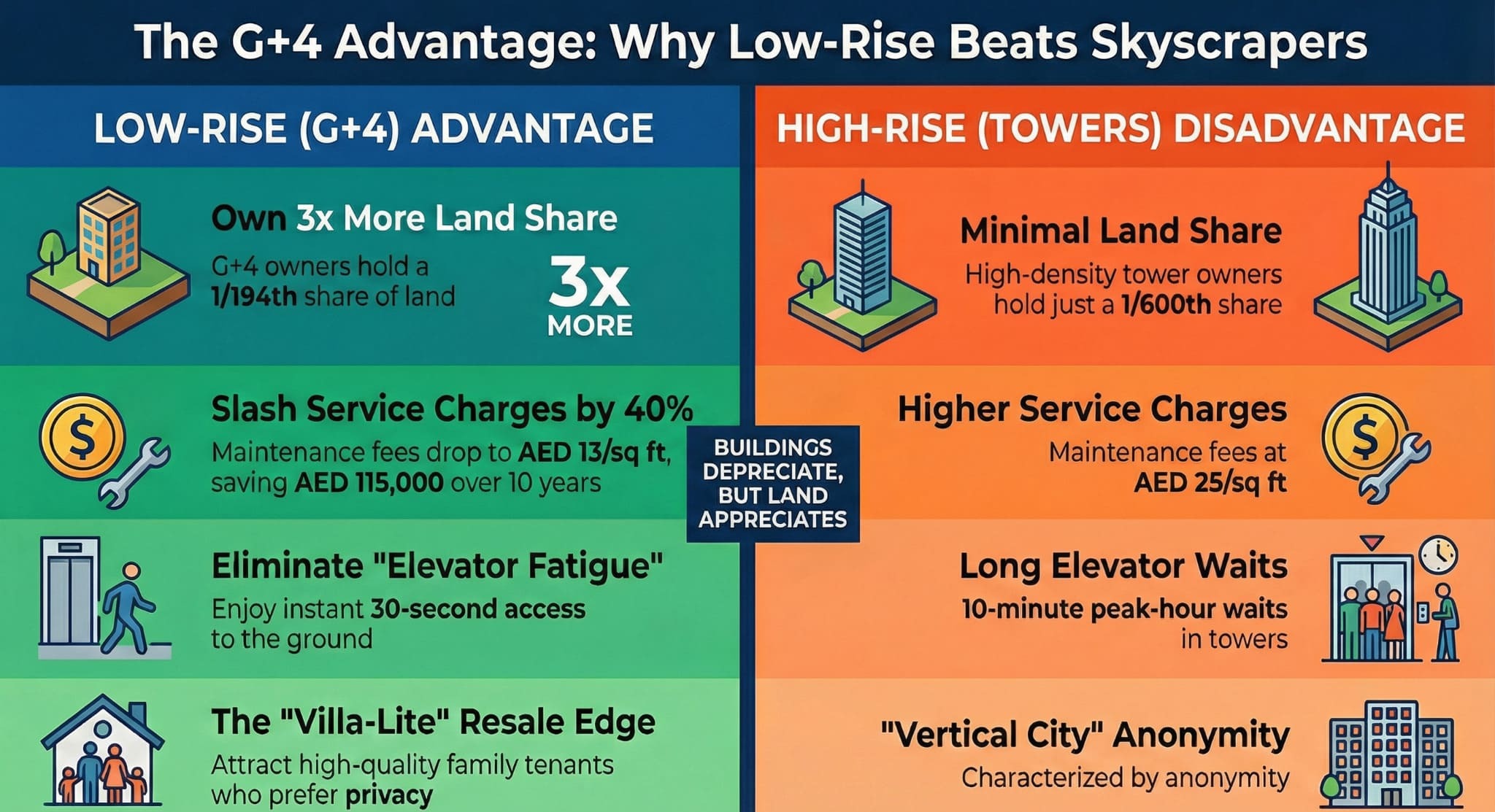

While skyscrapers offer iconic views, low-rise G+4 developments like Mayfair Nexus deliver superior long-term value retention through three core advantages:

Higher Undivided Share of Land (UDS): Owners hold a larger proportionate share of the appreciating asset—the land itself—compared to those in high-density towers.

Lower Service Charges: Without high-speed elevators, complex chiller systems, and aircraft warning lights, operational costs run 30-40% lower, significantly boosting net rental yields.

Scarcity & Privacy: The boutique nature of low-density living attracts quality long-term tenants seeking community, resulting in lower vacancy rates and stronger resale demand.

The Financial Anchor: Understanding Undivided Share of Land (UDS)

Real estate appreciation follows a simple rule:

Buildings depreciate. Land appreciates.

When you buy an apartment, you're not just buying concrete walls—you're buying a share of the plot beneath them. This is your Undivided Share of Land (UDS).

The Skyscraper Dilution

Imagine a plot worth AED 100 million:

Scenario A (Skyscraper): A 60-storey tower with 600 apartments. Your land share: 1/600th. Nearly negligible.

Scenario B (Mayfair Nexus): The same-sized plot hosts a G+4 community with 194 units. Your land share: 1/194th—over 3x larger.

Real World Example: The Arabian Ranches Effect

In 2015, apartments in Arabian Ranches sold for AED 900K. By 2026, those same units commanded AED 1.4M—a 55% increase driven primarily by land appreciation.

Meanwhile, similar-sized units in JBR high-rises saw only 28% growth despite premium waterfront location.

The difference? Land share.

Mayfair Nexus sits in the same land-rich corridor as Arabian Ranches 2, meaning your investment anchors to one of Dubai's fastest-appreciating land banks in Wadi Al Safa 7.

Why UDS Matters for Your Wallet

Redevelopment Value: In 40-50 years, when buildings age, property value is dictated by land value. High UDS means substantial compensation if the building is ever redeveloped. In skyscrapers, your land share dilutes to almost nothing.

Capital Stability: During market corrections, land-rich assets tend to hold value better. Land is finite; "air space" in new towers is virtually infinite.

The Operational Edge: Cutting the Fat from Service Charges

For investors, Gross Yield is vanity; Net Yield is sanity. The biggest killer of Net Yield in Dubai? Service charges.

High-rise luxury towers are engineering marvels, but expensive to maintain:

- High-Speed Elevators: Maintenance contracts for lifts traveling 50 floors cost exponentially more

- Chiller & HVAC: Pumping cooled water up 200 meters demands massive energy consumption

- Facade Cleaning: Specialized cradles and abseiling teams just to clean windows

The Low-Rise Efficiency

Mayfair Nexus is designed for operational leanness. A 4-storey building uses standard, energy-efficient systems costing a fraction to maintain.

The Result: Service charges in Dubailand's low-rise communities typically range from AED 12–15 per sq. ft., compared to AED 20–30+ in Dubai Marina or Downtown towers.

The Math: On a 1,000 sq. ft. apartment, this saves approximately AED 10,000 annually. Over 10 years, that's AED 100,000+ of pure profit staying in your pocket.

The Hidden Costs No One Talks About

Beyond service charges, high-rise living carries invisible expenses:

Cooling Tax: Higher floors experience extreme heat exposure. AC costs on floor 40+ run 20-30% higher than ground-level units.

Elevator Downtime: When lifts break, residents on floor 30+ face daily stair marathons. At Mayfair Nexus, maximum climb is 4 floors—a minor inconvenience, not a crisis.

Moving Costs: High-rise moves require crane rentals and specialized services (AED 8,000-15,000). Low-rise moves: AED 2,000-4,000.

Annual Hidden Cost Difference: ~AED 11,000/year

The Psychology of "Human Scale" Living

Post-2020, global architecture shifted toward what we call "Human Scale" design.

Elevator Fatigue

Living on the 45th floor sounds glamorous until you forget your keys or need to walk the dog. In high-rises, waiting for elevators during rush hour can take 5–10 minutes, creating a barrier between you and the outside world.

The Nexus Freedom: You're never more than seconds from the ground floor. The connection to the Zen Garden, pool, and parking is immediate and frictionless.

Community vs. Anonymity

Skyscrapers can feel like vertical cities of strangers. With hundreds of neighbors, anonymity is the norm.

In a boutique G+4 development, the scale is intimate. You recognize faces in the hallway. The pool deck isn't a crowded public beach—it's a private club for a select few.

This fosters belonging, a key pillar of the Seven Mayfair brand promise.

Privacy: The Ultimate Luxury

In a city that's always "on," silence and privacy have become ultimate commodities.

High-density districts like Business Bay are vibrant but noisy. Wadi Al Safa 7 offers a different soundscape. Dominated by villas (Arabian Ranches 2, The Acres) and low-rise buildings, population density is significantly lower.

Visual Privacy: Your view isn't another glass tower staring back. It's internal courtyards, landscaped gardens, or the open horizon.

Acoustic Privacy: G+4 buildings don't trap street noise the way urban canyons of skyscrapers do.

Faster Resale: The Liquidity Factor

Who buys your apartment when you sell?

Investor Buyers: Seek ROI (Lower service charges = Win)

End-User Buyers: Want livability (Privacy, community, low density = Win)

Low-rise apartments appeal to a massive demographic often priced out of villas but refusing high-rises: Families.

Families with young children prefer ground-floor connectivity. They hate elevator waits with strollers. They want to hear birds from their balcony, not wind shear.

By owning a unit in Mayfair Nexus, you hold an asset appealing to the "Villa-Lite" buyer—the largest and most stable segment of Dubai's property market.

Mayfair Nexus: Boutique Living Perfected

Mayfair Nexus isn't just a low-rise building—it demonstrates how thoughtful architecture creates lasting value.

Villa Features in an Apartment:

- Private Jacuzzis: Select units feature private jacuzzis on spacious terraces

- Private Gardens: Ground-floor units include green patches, blurring the line between apartment and townhouse

- Wellness Core: Central Zen Garden and Open-Air Yoga Park act as extensions of your living space

Smart Infrastructure: While architecture embraces tradition, the technology is futuristic. Integrated Smart Home Automation delivers efficiency and convenience at your fingertips.

The Bottom Line

The era of "bigger is better" is fading. The future belongs to "smarter is better."

Investing in G+4 communities like Mayfair Nexus is strategic. It's a choice for:

✅ Higher Intrinsic Value (through UDS)

✅ Higher Net Income (through lower service charges)

✅ Higher Quality of Life (through privacy and community)

Consider this: A view is temporary. Land ownership is permanent.

FAQs

Q 1: What is G+4 in Dubai real estate?

A: G+4 stands for Ground plus 4 floors, describing low-rise residential buildings with a maximum of 5 levels. In Dubai real estate, G+4 developments like Mayfair Nexus offer boutique community living with higher land ownership shares (UDS), lower service charges (40% less than high-rises), and better family-friendly amenities. These properties are increasingly popular in Dubailand areas like Wadi Al Safa 7, delivering 5.8-6.5% net rental yields compared to 3-4% in high-rise towers.

Q 2: Are low-rise apartments a better investment than high-rise towers in Dubai?

A: Low-rise G+4 apartments typically offer superior investment returns through three advantages: (1) 3x larger Undivided Share of Land providing better long-term appreciation, (2) 40% lower service charges boosting net rental yield by 2-3%, and (3) higher buyer demand from families seeking villa-style living at apartment prices. Historical data shows Dubailand low-rise properties appreciated 55% (2015-2025) versus 28% for comparable high-rises, making them stronger long-term investments.

Q 3: What is Undivided Share of Land (UDS) and why does it matter?

A: Undivided Share of Land (UDS) is your proportionate ownership of the land beneath your apartment building. In Dubai, UDS directly impacts long-term property value because land appreciates while buildings depreciate. A G+4 unit offers 3-6x larger UDS than high-rise towers (1/194 vs 1/600), providing greater redevelopment value, better mortgage terms, and stronger capital stability during market corrections—critical for serious property investors.

Q 4: How much can I save on service charges with low-rise apartments in Dubai?

A: Low-rise G+4 apartments in Dubailand charge AED 12-15 per sq ft annually versus AED 20-30 for high-rise towers. For a 1,000 sq ft apartment, this saves AED 10,000-15,000 yearly—totaling AED 115,000+ over 10 years. Lower costs result from simpler elevator systems, reduced cooling requirements, and easier maintenance access, significantly boosting net rental yield for Dubai property investors.

Q 5: Is Wadi Al Safa 7 a good location for property investment in Dubai?

A: Wadi Al Safa 7 offers exceptional investment potential as an emerging Dubailand district with strong infrastructure development. The Dubai Metro Blue Line (opening 2029) will connect the area to Silicon Oasis and Academic City, historically driving 35-50% appreciation within 3 years of metro access. Current properties range from AED 1.18M-1.3M with projected 25-35% appreciation by 2028-2029. The district's villa-dominated character creates scarcity value for quality apartments.

Q 6: What is the expected ROI for off-plan apartments in Dubailand 2026?

A: Off-plan apartments in Dubailand developments like Mayfair Nexus typically deliver 25-35% capital appreciation over 3 years (purchase to handover), plus 7-8% gross rental yield post-completion. With lower G+4 service charges, net rental yield reaches 5.8-6.5% versus 3-4% in high-rise towers. Total 5-year returns often exceed 40-50% including rental income, particularly for properties near upcoming Metro Blue Line stations.

Q 7: Are G+4 boutique apartments suitable for families in Dubai?

A: G+4 apartments are ideal for Dubai families due to quick ground access (no long elevator waits with strollers), private gardens on ground floors, safer community environments with lower density, proximity to top schools in areas like Wadi Al Safa 7 (JESS Arabian Ranches, Ranches Primary), and dedicated children's play areas. Properties like Mayfair Nexus offer villa-style amenities at 70% lower prices than actual villas.

Q 8: How does the Dubai Metro Blue Line affect Wadi Al Safa 7 property prices?

A: The Dubai Metro Blue Line (operational 2029) will significantly boost Wadi Al Safa 7 property values. Historical data from Red Line expansion shows properties within 1km of stations appreciated 35-50% in the 3 years following metro access. Current off-plan purchases in Wadi Al Safa 7 offer pre-infrastructure pricing, with handovers (2028) perfectly timed before metro opening—maximizing appreciation potential for early investors.

Q 9: What payment plans are available for Mayfair Nexus apartments?

A: Mayfair Nexus offers a flexible 70/30 off-plan payment structure: 70% paid during construction (2026-2028) in installments, and 30% on handover (Q4 2028). With starting prices from AED 1.18M, initial investment requires only AED 118K-130K (10% booking). This payment plan allows investors to control appreciating assets with minimal capital while benefiting from construction-phase value growth.

Q 10: Can foreigners buy freehold property in Wadi Al Safa 7 Dubai?

A: Yes, Wadi Al Safa 7 is a designated freehold zone where foreign nationals and expats can purchase property with 100% ownership rights in perpetuity. All Mayfair Nexus units qualify for freehold ownership, UAE residence visa eligibility (for properties valued AED 750K+), and full inheritance rights. There are no restrictions on nationality, making it accessible to global investors.